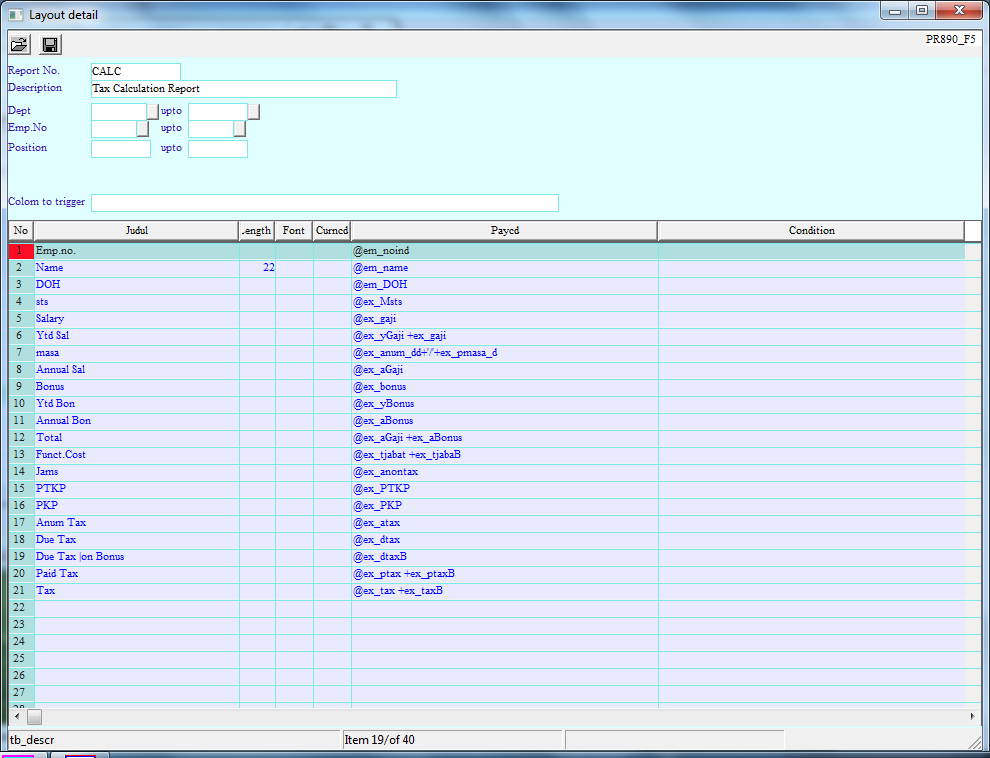

PR890 - Tax Calculation Report

Laporan perhitungan pph dapat disusun sesuai kebutuhan seperti contoh:

Variable untuk menyusun laporan perhitungan pajak adalah sbb:

| ex_masa | = | |

| ex_masa_dd | = | |

| ex_masa_mm | = | |

| ex_anum_dd | = | jumlah masa kerja dalam hari |

| ex_anum_mm | = | jumlah masa kerja dalam bulan |

| ex_pmasa_d | = | jumlah masa kerja dalam hari dari hire sampai bulan berjalan |

| ex_pmasa_m | = | jumlah masa kerja dalam bulan dari hire sampai bulan berjalan |

| ex_Msts | = | Payroll Tax Status |

| ex_gaji | = | current month income |

| ex_bonus | = | current month irregular income (bonus) |

| ex_n_final | = | current final income (grossup) |

| ex_g_final | = | current final income (gross) |

| ex_ygaji | = | ytd income |

| ex_ybonus | = | ytd bonus |

| ex_y_nfinal | = | ytd final income (grossup) |

| ex_y_gfinal | = | ytd final income (gross) |

| ex_ytaxal | = | ytd tax allowance |

| ex_ytaxalb | = | ytd tax allowance on bonus |

| ex_y_taxalf | = | ytd tax allowance on final |

| ex_ytjabat | = | ytd functional cost |

| ex_ytjabab | = | ytd functional cost on bonus |

| ex_ynontax | = | ytd additional nontaxable income |

| ex_ynontax1 | = | ytd additional nontaxable income (one time) |

| ex_ypnsion | = | ytd pension |

| ex_ypnsion1 | = | ytd pension (one time) |

| ex_nontax | = | current nontaxable income (JHT & JP) |

| ex_nontax1 | = | current one time nontaxable income (JHT & JP) |

| ex_pnsion | = | current pension |

| ex_pnsion1 | = | current one time pension |

| ex_taxal | = | current tax allowance |

| ex_taxalb | = | current tax allowance on bonus |

| ex_taxalf | = | current tax allowance on final |

| ex_agaji | = | annual income |

| ex_abonus | = | annual bonus |

| ex_anetto | = | annual gross income – functional cost – nontax (JHT & JP) |

| ex_agross | = | annual gross income + prev netto – functional cost – nontax (JHT & JP) |

| ex_tjabat | = | annual functional cost |

| ex_tjabab | = | annual functional cost on bonus |

| ex_anontax | = | annual nontax (JHT & JP) |

| ex_apnsion | = | annual pension |

| ex_ptkp | = | PTKP |

| ex_pkp | = | taxable income |

| ex_atax | = | annual tax |

| ex_ataxb | = | annual tax on bonus |

| ex_dtax | = | due upto current period tax |

| ex_dtaxb | = | due upto current period tax on bonus |

| ex_dtaxgy | = | ytd tax borne by govt. |

| ex_dtaxgm | = | due upto current period tax borne by govt. manual |

| ex_dtaxgov | = | due upto current period tax borne by govt. |

| ex_tax | = | current tax |

| ex_taxb | = | current tax on bonus |

| ex_taxf | = | current tax on final |

| ex_taxg | = | current tax by gov. |

| ex_ptax | = | paid tax |

| ex_ptaxb | = | paid tax on bonus |

| ex_ptaxf | = | paid tax on final |

| ex_ptaxg | = | paid tax by gov. |

| ex_pvNett | = | previous netto |

| ex_pvTax. | = | previous tax |

Last Edited : 7/3/2023 By : 0112